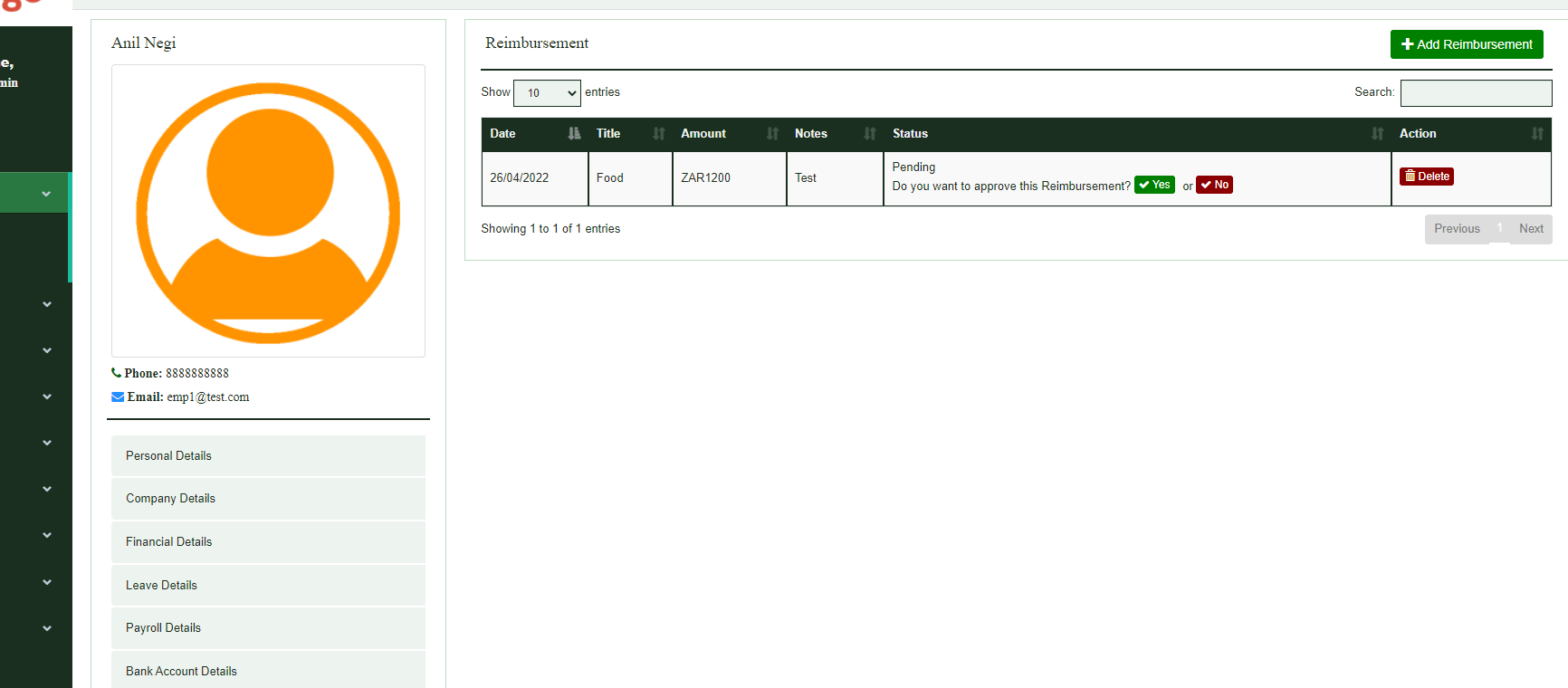

Reimbursement, Loan And Advance Payment Management System

Reimbursement is generally associated with business expenses. Many organizations have policies framing when they will reimburse employees for personal costs. Typically, these expenses are related to travel and can include the costs associated with food, hotels, ground transportation, and flights. A company may also reimburse employees for other types of expenses, like tuition reimbursement for college courses or continuing education classes.

Types of Reimbursement

Insurance

Beyond business, reimbursement is also used in the insurance industry. At the point when a health insurance policyholder needs urgent medical treatment, the policyholder is unlikely to have the time to contact the insurer to decide the degree to which the policy covers costs. The policyholder might need to pay for medical services, medicines or related expenses. On the other hand, the insurance policy might require that the policyholder cover certain personal expenses before seeking reimbursement. This is common in the case of wellness reimbursement. An insurer may reimburse up to a specific sum every year if a policyholder pays for and actively participates in a fitness program at a qualified fitness center. In both cases, the party that paid for the personal expenses can look for reimbursement from the insurance agency for any incurred expenses covered under the insurance policy.

Taxes

Reimbursement is also normal with taxes paid to the state and federal government. Most income taxpayers have government taxes withheld each pay period through payroll deductions, which doesn’t consider the credits that a taxpayer might be entitled to due to other taxes paid or expenditures made. Contractors pay taxes in quarterly estimated tax payments. Tax refunds provided to the citizen by the government are a type of reimbursement, as the money being returned to the taxpayer is due to a previous overpayment.

Legal

A kind of reimbursement called reimbursement alimony applies to the legal sector. Reimbursement alimony is an order given by a judge and is a payment made to an ex- spouse as a repayment for time money and resources invested in the spouse’s financial prospects and growth. An individual in a divorce settlement who worked full time to help their partner through college might be entitled for reimbursement of alimony if the partner has graduated and is now earning.

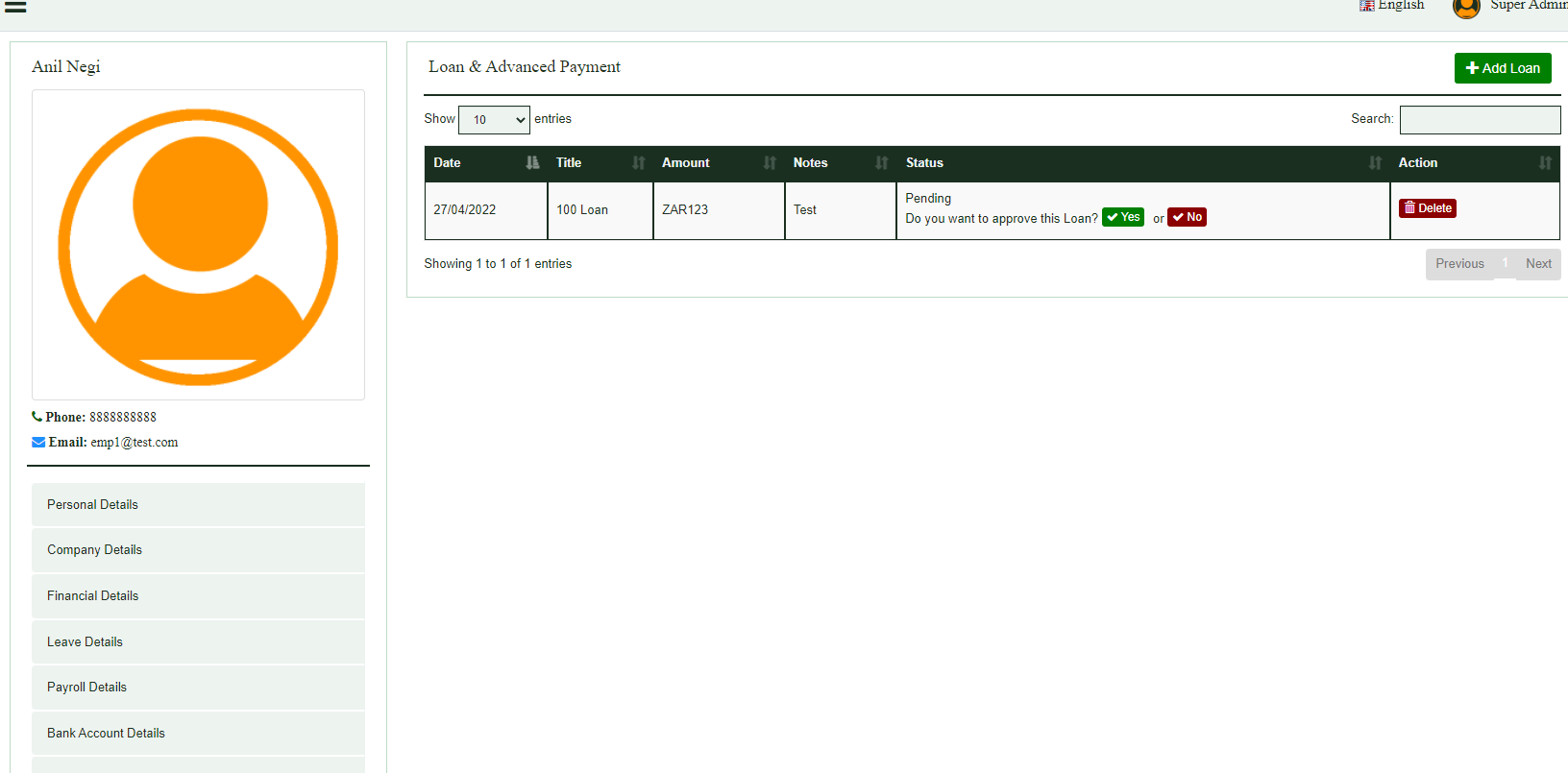

LOAN

The term loan refers to a sort of credit vehicle in which an amount of money is lent to another party in return for future repayment of the value and principal amount. Generally, in many cases, the moneylender also adds interest or financial charges to the principal value which the borrower must repay in addition to the principal balance. Loans might be for a particular, one-time amount, or they might be available as an open-ended line of credit up to a specified limit. Loans come in a wide range of structures including secured, unsecured, commercial, and personal loans.

Types of Loans

Loans come in many different forms. There are some factors that can differentiate the costs associated with them along with their contractual terms.

Secured vs. Unsecured Loan

Loans can be secured or unsecured. Home loans and vehicle loans are secured loans, as they both are backed or secured by collateral. In these cases, the collateral is the asset for which the loan is given, so the collateral for a mortgage is the home, while the vehicle gets a car loan. Borrowers might be required to set up different forms of collateral for other types of secured loans if required.

Credit cards and signature loans are unsecured loans and they are not backed by collateral. Unsecured loans have higher financing interest rates than secured loans because the risk is higher than secured loans. That is because the moneylender of a secured loan can repossess the collateral if the borrower defaults. Rates tend to fluctuate in unsecured loans relying upon numerous factors including the borrower’s credit history.

Revolving vs. Term Loan

Loans can also be described as revolving or term loans. A revolving loan can be spent, reimbursed, and spent again, while a term loan refers to a loan paid in equal monthly installments over a set period. A credit card is an unsecured revolving loan, while the home equity line of credit (HELOC) is a secured revolving loan. Conversely, a vehicle loan is a secured, term loan, and a signature loan is an unsecured, term loan.

ADVANCE PAYMENT

Advance payment is a sort of payment made ahead of its normal schedule; for example, paying for a decent or a service before one receives it. Advance payment is required by venders as a protection against nonpayment, or to cover the vendor’s personal expenses for providing the service or product.

There are many situations where advance payments are required. Customers with terrible credit might be required to pay organizations in advance, and insurance agencies by and large require an advance payment in order to extend coverage to the insured party.

Advance payments are reported as an asset on the balance sheet of the organization. When these are used, the assets are spent and reported on the income statement for the period in which they are incurred.

Advance payments are made in two cases. They might allude to the amount of cash paid before the contractually negotiated due date, or they might be required before the goods or services demanded are obtained.

Example of Advance Payments

There are few examples of advance payments. For example a prepaid cell phone. Service providers require payment for cell services that will be used by the customer one month in advance. If advance payment is not received, the service will not be provided.