Income and Expense Management in a Company

Income and expense management is essential for a company’s financial stability and growth. It involves tracking revenue, controlling costs, budgeting, and ensuring positive cash flow. Effective management helps businesses allocate resources wisely, minimize financial risks, and maximize profits. A well-structured approach ensures long-term sustainability and informed decision-making for financial success.

Managing income and expenses is a fundamental aspect of running a business. A well-organized financial system ensures that a company remains profitable, avoids cash flow problems, and meets its long-term goals. This guide explores different aspects of income and expense management, including revenue tracking, budgeting, cost control, debt management, tax planning, and financial reporting. By implementing the best practices outlined in this document, businesses can optimize their financial resources, make informed decisions, and sustain growth.

1. Tracking Company Income & Revenue

Tracking income is vital for any business, as it provides insights into financial performance and sustainability. Revenue is the primary source of funds that fuels business operations, expansion, and investment in new opportunities. Without proper tracking, a company may face financial instability, delayed payments, or even legal issues related to taxation. Companies must maintain an organized system to record and categorize income sources accurately. Using modern accounting software and maintaining detailed financial records ensures transparency and allows businesses to assess their financial health. Effective revenue tracking enables better budgeting, forecasting, and long-term strategic planning.

Types of Business Income:

✅ Sales Revenue – Income generated from selling products or services.

✅ Subscription Fees – Recurring payments from customers for continuous service.

✅ Investment Income – Profits from stocks, bonds, real estate, or other financial investments.

✅ Government Grants & Subsidies – Financial aid received from governmental organizations.

✅ Royalties & Licensing Fees – Earnings from intellectual property rights.

✅ Consulting & Professional Fees – Income earned by providing expert advice or services.

✅ Affiliate Marketing & Partnerships – Earnings from partnerships and referral programs.

2. Categorizing and Controlling Business Expenses

Managing business expenses is just as important as tracking revenue. Poor expense management can lead to overspending, financial mismanagement, and reduced profitability. By categorizing expenses into fixed, variable, and discretionary costs, businesses can identify where money is being spent and look for ways to optimize costs. Regular audits and expense tracking help detect financial leaks and improve cost-efficiency. Smart expense management strategies ensure that funds are allocated effectively, preventing unnecessary financial burdens and allowing businesses to remain competitive.

Types of Expenses:

🔹 Fixed Costs: Rent, salaries, insurance, software subscriptions, and equipment lease payments.

🔹 Variable Costs: Raw materials, production expenses, logistics, and marketing.

🔹 Operational Costs: Office supplies, utility bills, employee training, and IT support.

🔹 Financial Expenses: Loan repayments, credit card fees, interest charges, and tax payments.

🔹 Capital Expenditures: Investments in infrastructure, new equipment, or technology upgrades.

🔹 Discretionary Expenses: Travel, entertainment, bonuses, and promotional activities.

3. Creating and Managing a Business Budget

A business budget acts as a roadmap for financial decision-making, ensuring that resources are used efficiently. A well-planned budget helps companies allocate funds to essential operations, manage unforeseen expenses, and avoid unnecessary debt. It provides a framework for monitoring financial progress and making adjustments as needed. Companies that follow strict budgeting principles are better prepared to handle economic fluctuations and business challenges. A good budget also supports financial discipline, helping businesses set achievable financial goals while maintaining profitability and liquidity.

Steps to Create a Business Budget:

1️⃣ Estimate Revenue: Forecast future income based on historical data.

2️⃣ Identify Fixed & Variable Costs: Categorize essential and non-essential expenses.

3️⃣ Allocate Departmental Budgets: Distribute funds based on operational needs.

4️⃣ Set an Emergency Reserve: Allocate a contingency fund for unexpected costs.

5️⃣ Review & Adjust Regularly: Update the budget periodically to reflect changes.

4. Cash Flow Management: Maintaining Liquidity

Cash flow management ensures that a business has sufficient funds to cover day-to-day expenses, settle debts, and invest in growth opportunities. A company with poor cash flow management may struggle with late payments, excessive borrowing, or financial crises. Maintaining liquidity requires businesses to track inflows and outflows, streamline invoicing, and reduce unnecessary spending. Companies should regularly forecast cash flow to anticipate future financial needs and implement strategies to prevent cash shortages. By ensuring a steady cash flow, businesses can operate smoothly, take advantage of investment opportunities, and maintain strong financial health.

Best Practices for Managing Cash Flow:

✔️ Monitor Cash Inflows & Outflows daily.

✔️ Issue Invoices Promptly to avoid delayed payments.

✔️ Offer Multiple Payment Options to improve customer payment speed.

✔️ Negotiate Longer Payment Terms with suppliers.

✔️ Reduce Overhead Costs by streamlining operations.

✔️ Use Cash Flow Forecasting to anticipate future financial needs.

5. Expense Reduction Strategies for Businesses

Reducing expenses is essential for increasing profit margins and maintaining a sustainable business model. Many companies struggle with hidden costs that drain resources without adding significant value. By analyzing spending patterns, businesses can identify cost-saving opportunities without compromising productivity. Smart expense reduction strategies include optimizing vendor contracts, leveraging technology, and minimizing wastage. A proactive approach to cost control ensures that businesses remain competitive and financially stable while continuing to grow.

Cost-Cutting Strategies:

🔸 Automate Repetitive Processes to save on labor costs.

🔸 Reduce Energy Consumption to lower electricity bills.

🔸 Encourage Remote Work to save on office space expenses.

🔸 Switch to Affordable Suppliers without compromising quality.

🔸 Limit Travel Expenses by using video conferencing tools.

6. Debt Management & Financing Options

Businesses often rely on loans and external funding to finance growth, but excessive debt can lead to financial distress. Proper debt management involves understanding loan structures, prioritizing repayments, and maintaining a good credit score. Businesses should explore various financing options to secure funds with favorable terms. Avoiding high-interest debt and refinancing existing loans can help reduce financial burdens. A well-structured debt strategy ensures that businesses can meet financial obligations without jeopardizing cash flow or profitability.

Debt Management Tips:

✔️ Prioritize High-Interest Debt Payments to reduce overall costs.

✔️ Refinance Loans for lower interest rates.

✔️ Limit Borrowing to necessary business needs only.

✔️ Maintain a Good Credit Score for favorable financing options.

7. Tax Planning and Compliance

Tax planning is a crucial part of financial management that ensures businesses comply with legal obligations while minimizing tax liabilities. Proper tax management helps companies avoid penalties, maximize deductions, and plan financial activities efficiently. Many businesses fail to take advantage of available tax benefits due to poor planning or lack of knowledge. By keeping accurate records and working with financial advisors, companies can optimize tax savings while staying compliant with government regulations. Strategic tax planning also enables businesses to reinvest more in growth and innovation.

Tax Management Strategies:

✅ Claim Deductions on business expenses.

✅ Maintain Accurate Tax Records to avoid audits.

✅ Hire a Tax Consultant for compliance and savings.

✅ File Tax Returns on Time to prevent penalties.

8. Financial Reporting & Decision-Making

Financial reporting provides businesses with valuable insights into their financial health and performance. Accurate and timely reports help management make informed decisions, improve operational efficiency, and ensure transparency. Key financial reports include profit and loss statements, balance sheets, and cash flow statements. Regular financial analysis helps identify trends, detect issues early, and implement corrective actions. Strong financial reporting practices contribute to long-term business success by fostering accountability and strategic planning.

Essential Financial Reports:

📊 Profit & Loss Statement – Shows revenue and expenses.

📊 Balance Sheet – Highlights assets, liabilities, and shareholder equity.

📊 Cash Flow Statement – Tracks money movement.

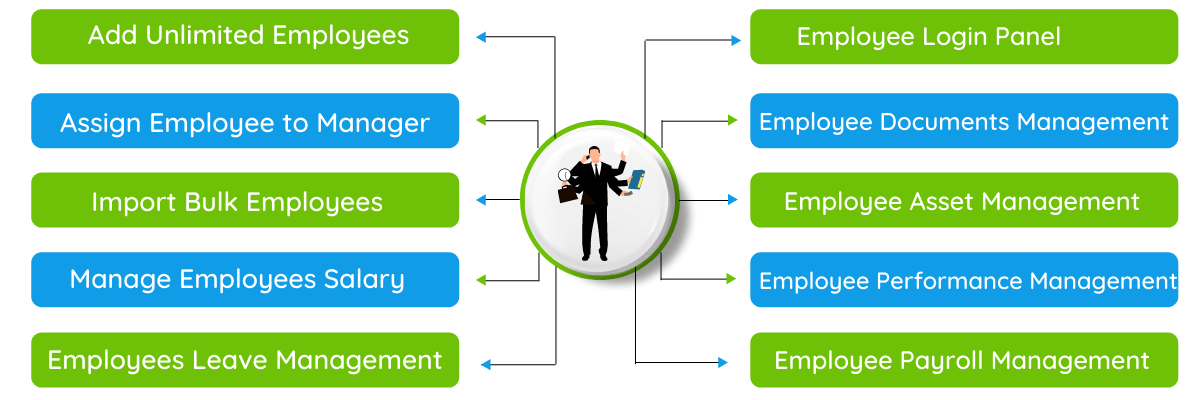

Managing Income and Expenses with PHP HR Expense Tool

Effective income and expense management is crucial for businesses to maintain profitability and financial stability. A well-structured system ensures that all financial transactions, from employee salaries to operational costs, are tracked efficiently. PHP HR Expense Tool simplifies this process by automating payroll, expense approvals, and financial reporting. It helps businesses keep a clear record of their expenditures, monitor budgets, and ensure compliance with tax regulations. With features like payroll processing, employee expense management, and integration with accounting software, PHP HR Expense Tool provides an organized way to handle financial operations, reducing manual errors and optimizing overall cost efficiency.

Here’s how PHP HR Expense Tool can handle income and expense management effectively:

1. Payroll Management for Expense Tracking

PHP HR Expense Tool automates salary processing, ensuring that all employee salaries, taxes, and benefits are recorded as business expenses. It generates detailed payroll reports, helping businesses track how much is spent on employee compensation.

✅ Automatic Salary Calculation

✅ Tax and Deductions Management

✅ Payroll Reports for Budgeting

2. Employee Expense Management

Companies often reimburse employees for travel, meals, and other work-related expenses. PHP HR Expense Tool allows employees to submit expense claims, and HR can review and approve payments seamlessly.

✅ Employee Expense Submission

✅ Approval Workflow for Expenses

✅ Expense Report Generation

3. Financial Reports for Income & Expenses

PHP HR Expense Tool provides detailed reports on payroll expenses, tax deductions, and allowances, helping companies maintain a clear financial overview. These reports support budgeting, cost control, and financial planning.

✅ Monthly & Annual Payroll Expense Reports

✅ Tax Deduction Reports

✅ Budgeting Assistance

4. Leave and Overtime Cost Calculation

Overtime and leave payouts can affect business expenses. PHP HR Expense Tool tracks employee work hours, overtime payments, and leave balances, ensuring accurate compensation and cost monitoring.

✅ Overtime Compensation Management

✅ Paid Leave Cost Calculation

✅ Reduction of Unnecessary Overtime Costs

5. Integration with Accounting Software

While PHP HR Expense Tool itself does not function as a full-fledged accounting tool, it can be integrated with accounting software to sync income, expenses, and payroll data, ensuring streamlined financial management.

✅ Export Payroll & Expense Data to Accounting Software

✅ Track Income vs. Salary & Operational Costs

✅ Automate Accounting Entries

6. Cost Reduction Through HR Automation

By reducing manual HR work, PHP HR Expense Tool helps businesses cut down on operational costs. The system automates attendance, payroll, and compliance, minimizing errors and unnecessary spending.

✅ Minimizes Manual Data Entry Errors

✅ Reduces HR Administrative Costs

✅ Improves Financial Accuracy & Efficiency

7. Compliance & Tax Filing Support

PHP HR Expense Tool ensures that businesses remain compliant with salary tax laws, employee benefits, and statutory deductions, reducing financial penalties and unexpected expenses.

✅ Automatic Tax Calculations

✅ Compliance with Government Regulations

✅ Avoidance of Late Payment Penalties

FAQs on Income & Expense Management

What is Income & Expense Management, and why is it important for businesses?

Income & Expense Management is the process of tracking, recording, analyzing, and controlling the financial transactions of a business. It involves monitoring both incoming revenue (income) and outgoing payments (expenses) to ensure financial stability and profitability. Proper management of income and expenses helps businesses maintain positive cash flow, allocate budgets effectively, and plan for future growth. It also aids in tax compliance, reduces financial risks, and improves overall operational efficiency.

What are the key components of Expense Management in a company?

Expense Management involves handling various types of business expenditures, which can be categorized as follows:

- Payroll Expenses: Salaries, wages, bonuses, and benefits paid to employees.

- Operational Costs: Rent, utilities, office supplies, maintenance, and other day-to-day business expenses.

- Business Travel & Reimbursements: Expenses related to employee travel, lodging, meals, and other work-related reimbursements.

- Vendor & Supplier Payments: Payments for raw materials, services, and outsourced work.

- Marketing & Advertising Costs: Expenses incurred for promotional activities, digital marketing, and branding efforts.

- Taxes & Compliance Fees: Government-imposed taxes, statutory deductions, and compliance-related charges.

Effective tracking of these components ensures that the company stays within its budget while optimizing financial performance.

How can businesses efficiently track their income and expenses?

Businesses can efficiently manage income and expenses through:

- Automated Payroll & HR Systems: Tools like PHP HR Expense Tool can streamline salary processing, tax deductions, and benefits tracking.

- Expense Tracking Software: Companies can use digital solutions to record daily expenditures and generate real-time financial reports.

- Budgeting & Forecasting Tools: Businesses should set financial goals and compare actual expenses with budgeted amounts to identify overspending areas.

- Bank Reconciliation & Accounting Integration: Regularly matching financial records with bank statements ensures accuracy and prevents fraud.

- Employee Reimbursement Processes: Businesses should implement a structured reimbursement policy for tracking employee claims efficiently.

Using these methods allows businesses to maintain transparency in financial transactions while preventing unnecessary losses.

How does PHP HR Expense Tool help in Income & Expense Management?

PHP HR Expense Tool is designed to assist businesses in automating financial workflows, tracking expenses, and generating reports. Some of its key benefits include:

- Automated Payroll Management: The tool calculates employee salaries, bonuses, and deductions, ensuring that payroll expenses are tracked accurately.

- Expense Claim Processing: Employees can submit reimbursement requests for travel, meals, and other work-related expenses, with approval workflows in place.

- Real-Time Financial Reporting: Businesses can access up-to-date income and expense reports, helping with decision-making and budget planning.

- Integration with Accounting Systems: The tool syncs payroll and expense data with accounting software, reducing manual data entry and improving financial accuracy.

By using PHP HR Expense Tool, companies can enhance their financial tracking capabilities while minimizing administrative burdens.

How does automation improve Expense Management?

Automating financial processes eliminates manual errors, saves time, and enhances data accuracy. The key benefits of automation in Expense Management include:

- Faster Payroll Processing: Automated systems calculate salaries, tax deductions, and reimbursements, reducing delays in salary payments.

- Error-Free Expense Recording: Digital tracking eliminates the chances of duplicate entries or missing expenses.

- Efficient Budgeting & Forecasting: Automated financial reports allow businesses to analyze spending patterns and optimize budgets.

- Better Compliance & Tax Management: Automation ensures that tax calculations and compliance reporting are done accurately, reducing legal risks.

By leveraging automation, companies can streamline their expense management and make data-driven financial decisions.

What are some common challenges businesses face in managing income and expenses?

Managing business finances can be complex due to several challenges, including:

- Cash Flow Mismanagement: If income and expenses are not tracked properly, businesses may struggle with cash shortages or excess spending.

- Unrecorded or Overlooked Expenses: Small expenses may be ignored, leading to inaccurate financial reports.

- Budget Overruns: Poor financial planning can result in exceeding budget limits, impacting profitability.

- Compliance & Taxation Issues: Failing to meet tax deadlines or incorrect tax filings can result in penalties.

- Inefficient Approval Processes: Manual expense approvals may lead to delays and operational inefficiencies.

By addressing these challenges with the right tools and financial strategies, businesses can ensure smooth financial operations.

How can companies reduce unnecessary expenses and optimize spending?

Companies can cut down unnecessary expenses by implementing the following strategies:

- Setting Clear Budget Limits: Define spending thresholds for different departments to prevent overspending.

- Regular Expense Audits: Periodic reviews of financial records help identify cost-cutting opportunities.

- Negotiating Vendor Contracts: Businesses should negotiate with suppliers to secure better pricing and bulk discounts.

- Encouraging Cost-Conscious Culture: Training employees on financial discipline helps reduce unnecessary expenditures.

- Using Technology for Expense Tracking: Implementing tools like PHP HR Expense Tool automates tracking and prevents fraudulent expense claims.

By continuously monitoring expenses and adopting cost-saving measures, companies can maintain profitability and improve financial stability.

How does payroll management impact a company’s expense management?

Payroll is often one of the largest expenses for any company. Proper payroll management impacts expense management in the following ways:

- Accurate Salary Processing: Ensures that employees are paid correctly, avoiding payroll disputes and legal complications.

- Tax Compliance: Helps businesses calculate and withhold necessary taxes, reducing the risk of penalties.

- Budget Planning: Payroll reports assist in forecasting labor costs and managing workforce expenses.

- Efficiency in Employee Benefits Management: Automating payroll ensures timely processing of bonuses, incentives, and deductions.

A well-managed payroll system contributes to overall financial health and stability.

How can companies ensure compliance in financial management?

To maintain financial compliance, companies should:

- Follow Local Tax Laws: Businesses must stay updated on tax regulations and file returns on time.

- Maintain Accurate Financial Records: Proper bookkeeping practices help track transactions and meet legal requirements.

- Use Automated Compliance Tools: PHP HR Expense Tool helps businesses calculate taxes and manage payroll compliance automatically.

- Conduct Regular Audits: Internal and external audits ensure transparency in financial operations.

By staying compliant, companies can avoid penalties, legal issues, and reputational damage.

Effective income and expense management is essential for businesses to maintain financial stability, optimize spending, and drive growth. By implementing structured financial tracking, leveraging automation tools like PHP HR Expense Tool, and adopting cost-saving strategies, companies can enhance their financial efficiency and reduce unnecessary expenses. Proper payroll management, compliance with tax regulations, and accurate financial reporting further contribute to smooth operations and long-term profitability. With the right approach and technology, businesses can gain better control over their financial health, make data-driven decisions, and achieve sustainable success in an increasingly competitive market.