Employee Payroll Software

An employee payroll system is a software designed to organize all the tasks of employee payment and the filing of employee taxes.

An employee payroll system is a software designed to organize all the tasks of employee payment and the filing of employee taxes. These tasks can include keeping track of hours, calculating wages, withholding taxes and deductions, printing and delivering checks, and paying employment taxes to the government.

Employee payroll software is the list of all the employees to whom a company pays a salary. A payroll officer has to make careful planning of the whole month, keeping in mind all the events passed by. To make this tedious process automated the payroll software is used.

Payroll software that is designed to help manage employee information and other HR-related tasks is considered as Payroll and HR software. It assists in automating tasks, calculating accurate payroll, attendance tracking, and more.

Payroll management software helps in computing pay rates including statutory deductions such as PF and ESI, HRA, tax deductions, reimbursements according to CTC norms, employee documents management, email and document management in an organized way, keeping track of Employee attendance and loans and advances.

Payroll software is primarily meant to handle payroll for employees. This includes tracking the time and attendance of employees, calculating arrears and other salary parameters like PTax, PF, etc. Online payroll software lets your payroll department work on the go. This availability provides flexibility to the process.

Employee payroll software is an automated tool designed to handle various payroll-related tasks within an organization, ensuring that employees are paid accurately and on time. This software simplifies payroll processing by automating calculations for salaries, taxes, deductions, bonuses, and other compensation elements. It ensures compliance with tax laws, improves accuracy, and reduces the administrative workload on HR teams, enabling them to focus on other crucial tasks.

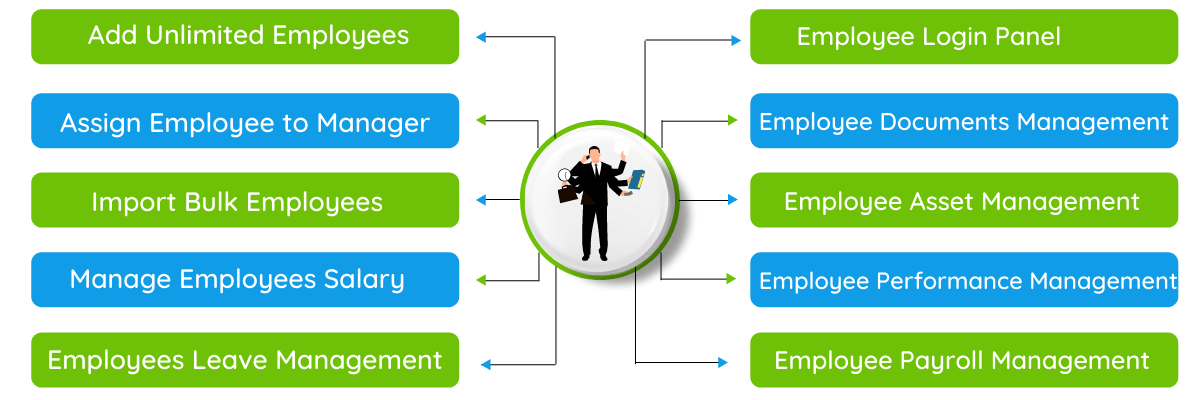

Key Features of Employee Payroll Software

- Salary Calculation

Payroll software automates the calculation of salaries, factoring in various elements such as overtime, allowances, bonuses, and deductions (taxes, provident fund, insurance, etc.). It ensures precise calculations for every pay cycle. - Tax Compliance

The software helps businesses stay compliant with local, state, and federal tax laws. It automatically calculates the tax deductions for employees and generates reports for tax filing. This minimizes the risk of penalties due to non-compliance. - Payroll Processing

Employee payroll software can handle complex payroll processing tasks such as distributing salary slips, processing bonuses, handling incentive payouts, and managing multiple payment cycles (weekly, bi-weekly, or monthly). - Leave and Attendance Integration

Payroll software often integrates with attendance and leave management systems to track employee leave balances and attendance patterns. This integration ensures that salary calculations take into account leaves taken, whether paid or unpaid. - Direct Deposit

Many payroll systems allow for direct deposit, enabling employees to receive their salaries directly into their bank accounts. This feature eliminates the need for physical checks and speeds up the payout process. - Employee Self-Service Portal

Most payroll software offers an employee self-service portal where employees can view their pay slips, track their leave balances, request reimbursements, and access tax-related documents. - Reporting and Analytics

Payroll software generates detailed reports that provide insights into company spending on salaries, taxes, bonuses, and other payroll-related costs. These reports help organizations make data-driven financial decisions. - Customizable Pay Structures

Payroll software can accommodate various pay structures such as hourly wages, salaried employees, or commission-based compensation, allowing organizations to define compensation rules as per their needs. - Audit Trail and Security

An important feature of payroll software is the ability to maintain an audit trail for all payroll-related activities. This ensures that there is a record of all changes and updates made to employee payroll data, offering transparency and accountability.

Benefits of Using Employee Payroll Software

- Time-Saving: Automates the time-consuming process of manual payroll calculations, saving HR teams a significant amount of time and effort.

- Accuracy: Reduces the chances of human error in calculations, ensuring employees are paid correctly.

- Compliance: Ensures compliance with local, state, and federal tax laws, preventing costly fines and penalties.

- Cost-Effective: By reducing manual work and the risk of errors, payroll software ultimately lowers administrative costs for businesses.

- Data Security: Payroll software keeps sensitive financial and personal data secure by using encryption and other security measures.

- Employee Satisfaction: Timely, accurate payroll processing leads to higher employee satisfaction and trust in the organization.

Popular Employee Payroll Software

- PHP HR Payroll

PHP HR Payroll is a comprehensive, open-source payroll software designed for small and medium-sized businesses. It automates payroll processes, including salary calculation, leave management, and tax compliance. PHP HR Payroll also offers employee self-service features, making it easy for employees to access their payslips and tax-related documents. With its customizable features, businesses can adapt the system to meet their specific payroll needs.

FAQs for Employee Payroll Software

Employee payroll software is essential for modern businesses, streamlining the payroll process and ensuring that employees are paid correctly and on time. With features like tax compliance, direct deposit, and employee self-service, payroll software offers significant time and cost savings. Choosing the right payroll software that fits your organization’s size, needs, and budget can simplify payroll management, reduce errors, and improve overall efficiency.