Employee Salary Management in System

Discover how an employee salary management system can streamline payroll, ensure compliance, and enhance accuracy.

Efficient employee salary management is a cornerstone of any successful organization. As businesses grow, the complexity of handling payroll increases, making manual processes time-consuming and prone to errors. A salary management system offers a structured and automated approach to streamline payroll tasks, ensuring accurate calculations, compliance with tax laws, and timely payments. By adopting such systems, organizations can focus on strategic goals while providing employees with a transparent and reliable payroll experience.

In today’s competitive business environment, ensuring employee satisfaction is crucial, and salary management plays a significant role. A well-implemented salary management system not only reduces administrative burdens but also fosters trust and transparency among employees. With features like automated payroll, compliance integration, and self-service portals, these systems simplify operations and empower employees with easy access to their salary details. For businesses looking to enhance efficiency and maintain compliance, transitioning to a salary management system is a smart and necessary investment.

Efficient employee salary management is vital for any organization. As businesses grow, handling salaries manually can become overwhelming and prone to errors. A systematic approach ensures accuracy, compliance, and transparency while saving time and resources. Here’s a detailed look at employee salary management in a system.

Importance of Salary Management

Salary management is more than just paying employees; it involves maintaining records, ensuring compliance with tax laws, and promoting employee satisfaction. A robust system streamlines this process, providing numerous benefits:

- Accuracy: Automated calculations minimize errors in deductions, bonuses, and taxes.

- Time Efficiency: Speeds up payroll processing, allowing HR teams to focus on other tasks.

- Transparency: Ensures clear communication of salary structures, deductions, and benefits.

- Compliance: Helps in adhering to local tax regulations and labor laws.

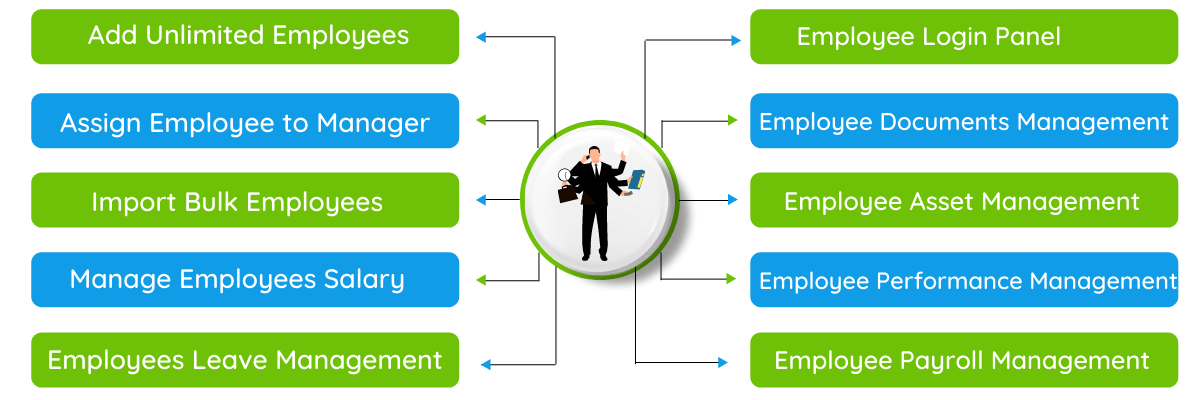

Features of a Salary Management System

A good salary management system integrates various functionalities to simplify payroll processes. Key features include:

- Automated Payroll Processing

Automates salary calculations, taking into account factors like attendance, overtime, bonuses, and deductions. - Tax and Compliance Integration

Ensures compliance with tax laws by automating tax calculations, deductions, and filings. - Employee Self-Service Portal

Provides employees access to their salary slips, tax details, and benefits, enhancing transparency. - Customizable Salary Structures

Allows organizations to tailor salary components like basic pay, allowances, and deductions as per their policies. - Data Security

Protects sensitive payroll data with encryption and secure access controls.

Benefits of Using a System for Salary Management

- Cost-Effectiveness: Reduces the need for extensive HR manpower and third-party payroll services.

- Accuracy: Eliminates human errors, ensuring employees receive correct payments.

- Flexibility: Adapts to varying payroll structures and organizational needs.

- Compliance Assurance: Reduces risks of penalties by adhering to tax and labor regulations.

- Real-Time Reporting: Offers insights into payroll trends, helping in strategic financial planning.

Choosing the Right System

When selecting a salary management system, consider the following:

- Scalability: Ensure it grows with your organization.

- User-Friendliness: Opt for a system with an intuitive interface to minimize training time.

- Integration Capabilities: Choose software that integrates with existing HR and accounting tools.

- Customer Support: Reliable support ensures smooth operations and quick issue resolution.

Every organization needs the proper management of the employees salaries without any misunderstandings. The organization with the small number of employees does not require the use of this Employee Salary Management in System. But for the organizations having thousands of employees it will be very difficult for the people to manage the salary of all the employees of the organization. To ensure proper management of the salaries of the organization, the employee salary management in system database project can be used. It will help in reducing most of the pen paper work of the organizations and helps in smooth functioning of it.

Employee salary management in system, each worker can receive emails concerning their salary slips, compensation slips and alternative necessary information concerning their remuneration. No additional bothersome queries from staff regarding their earnings slips! earnings are one in all the divisor that the folks add the organizations whole night and day. Some organizations can build the folks work by promising the workers regarding the increase within the earnings. the worker list will be maintained properly and exactly with the assistance of this information. It will contain the knowledge like name, age, designation, expertise and lots of alternative personal details. The salary details are going to be having the knowledge regarding worker id and also the salary. The salary are going to be got when the deductions like pf or the other deduction, quantity are going to be subtracted if there’s any grievance regarding the worker.

FAQs About Employee Salary Management in a System

What is an employee salary management system?

An employee salary management system is software that automates and streamlines the payroll process. It manages tasks like salary calculations, tax deductions, compliance reporting, and payslip generation.

Why should businesses use a salary management system?

A salary management system enhances efficiency, reduces manual errors, ensures compliance with labor laws, and provides transparency to employees. It saves time and resources while promoting trust and accuracy.

What are the key features of a salary management system?

Essential features include automated payroll processing, tax compliance, employee self-service portals, customizable salary structures, data security, and real-time reporting.

How does a salary management system ensure compliance with tax regulations?

The system automatically calculates applicable taxes, deductions, and contributions based on local laws. It also generates compliance reports and ensures timely filing to avoid penalties.

Can a salary management system handle bonuses and deductions?

Yes, it can process bonuses, overtime pay, and various deductions such as taxes, provident funds, or loans, ensuring accurate payouts.

Is a salary management system secure?

Reputable systems use encryption, multi-factor authentication, and secure access controls to protect sensitive payroll and employee data.

What is an employee self-service portal in salary management software?

This feature allows employees to access their payslips, tax details, and benefits information, promoting transparency and reducing HR workload.

Can small businesses benefit from a salary management system?

Absolutely! Small businesses can save time, reduce errors, and improve compliance by using an affordable and scalable salary management system.

How does a salary management system save time?

It automates repetitive tasks like salary calculations, tax deductions, and report generation, freeing up HR and finance teams to focus on strategic activities.

Is the system customizable for different salary structures?

Yes, most systems allow customization of salary components such as basic pay, allowances, deductions, and benefits to fit an organization’s policies.

How can a salary management system improve employee satisfaction?

By ensuring accurate and timely salary payments, offering transparency through self-service portals, and simplifying access to financial information, it fosters trust and satisfaction among employees.

What should I look for when choosing a salary management system?

Key considerations include scalability, ease of use, integration with existing systems, robust customer support, and advanced security features.

Implementing a salary management system ensures a seamless and professional approach to payroll, benefiting both organizations and their employees.

Adopting a systematic approach to employee salary management is no longer a luxury but a necessity. A well-implemented system enhances efficiency, ensures compliance, and boosts employee trust in the organization. By investing in the right tools, businesses can streamline payroll operations, minimize errors, and focus on achieving their broader objectives.